The NBA and Cable TV: A Relationship In Peril

The impending NBA media deal comes at a time when ESPN and TNT are fearing for the worst, while Apple and Amazon may be lurking in anticipation. Here is why:

Later this year, the NBA is expected to announce a new media rights deal. The current deal, which was announced in 2014, was a nine-year deal worth $24 billion signed with Disney-owned ESPN and Warner Bros.-owned Turner Sports (TNT). At the time, the deal was worth nearly three times the outgoing deal, and exploded the league’s annual media rights revenue from about $966 million to $2.6 billion. Team valuations also went through the roof, with recent transactions having NBA franchises selling at 8-10x revenue multiples, figures unheard of in industries outside of tech. This time, however, the outcome may not be nearly as lucrative.

Over the last 50 years in the United States, the growth of professional sports has been intrinsically tied to TV rights. TV executives realized that not only were sports great for selling advertising, they were also a great tool to entice customers into bundles that allowed them to sell the rest of their programming. This created a flywheel effect where more sports on television networks brought more cable subscribers which meant more revenue for television networks, part of this revenue was reinvested into the same sports leagues and thus leagues continued to grow. A symbiotic relationship.

Thus an incredibly profitable 4 decade run for sports leagues and the cable television networks that carried them had begun. In this time, the NBA has become one of the fastest growing sports leagues globally and this growth has been captured commercially. The behemoth that is the NFL is the only sports league that makes more money than the NBA annually.

Annual Revenue By US Sports League

NFL: $18.6 billion

NBA: $10.6 billion

MLB: $10.3 billion

NHL: $5.9 billion

MLS: $1.6 billion

This growth is not slowing down either, Forbes magazine estimates that in 2023 the league will generate close to $13 billion in revenue.

What is notable, however, is how much of this revenue is tied to media rights. The NBA’s growth is heavily reliant on their national media partners such as ESPN and Turner Sports being able to continue to pay for these rights. The league’s massive international profile is only enough to provide around $500 million annually from international TV providers such as Sky Sports and DAZN. Over time, the league hopes that social media, arena experiences and live events can provide a larger chunk of revenues. These, however, continue to be long-term ambitions.

Over the last couple of years, whispers around the league have claimed that NBA Commissioner Adam Silver has been looking to triple their current media rights deal. $75-80 billion is the figure that the league has allegedly been looking to reach. A steep valuation that would only be rivalled by the 10-year $110 billion deal that the NFL signed with CBS, FOX and Comcast - their longtime partners- as well as recent additions, Disney and Amazon Prime Video, in 2021.

Despite this, the NBA finds itself in a unique position. Not only does the league lack the NFL’s spectacular viewership numbers, it also finds itself renegotiating these rights at a time when their incumbent media partners are facing serious existential threats to their future revenues. We shall examine both these issues.

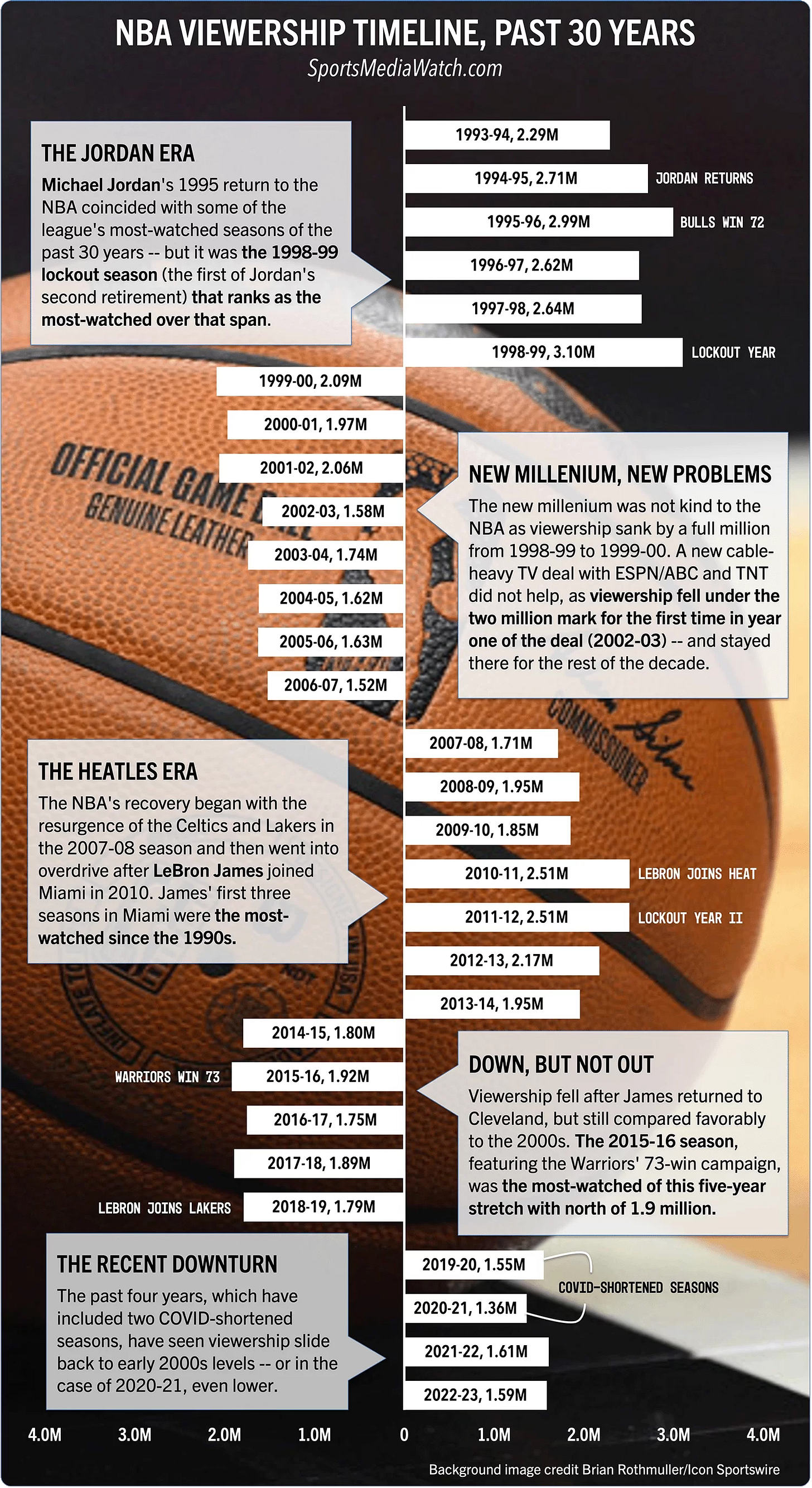

NBA viewership is dwindling. The heydays of the Jordan era are far behind us and this collapse in viewership is observable both in the regular season; which runs nearly daily for 7 months in between late October and April, and event based viewership such as the All Star game and the NBA Finals. Many theories have been put forward for this fall, which continues despite the league growing and reaching massive audiences via social media. Possibly a topic for another blog post.

The Cable Dilemma

Let’s go back to the television networks. During the successful 4 decade run we mentioned earlier, ESPN and TNT could only show so many games within a 24 hour span. It was not possible to appease every fan from every team. As a result, regional sports networks (RSN) were born. While being smaller than their national counterparts, these networks could show every game within a team’s regional market. These catered to loyal viewers who could be priced accordingly and thus RSN were great revenue generators.

The final evolution of the cable TV and sports marriage came when networks began bundling content together. ESPN was tied to Disney’s channels, TNT was tied to Warner Bros. channels and multiple RSNs had bundles with NBC and Fox. Cable companies could charge more and more and customers were more than willing to pay. This peaked in 2011 where 85% of households in the US paid for cable TV. This number is now below 60%.

The major catalyst for this change was streaming. Netflix, well capitalized after acculumulating cheap debt in a low interest rate environment, began to license content from traditional studios such as HBO and FX that traditionally aired on cable TV. This was the premium content, besides sports, that kept these cable subscriptions renewed by customers. These networks coexisted with Netflix at first, but began to compete with them by offering their own streaming services with their proprietary content. Namely Disney+, Hulu, HBO Max etc.

This came with a change of business model. Instead of simply syphoning revenue from people who signed up to cable as an afterthought, these companies now had to attract new customers to sign up to a new service without sports. The latter is much more difficult. Disney, HBO and FX had to put their best content on their sites as well as aggressively green light new shows and movies to catch up to Netflix’s deep content library. A very expensive endeavour.

A few years on from this pandemic phenomenon, the effects on cable TV are starting to take shape. Customers who were never that interested in sports now have much better alternatives to cable as all their favourite content is available on different streaming sites with no ads. Consequently, cable has very little to offer other than sports and news.

As we pivot back to the NBA angle, we can imagine now that a big NBA fan still pays for cable, but a casual NBA fan who had cable for other reasons now probably doesn’t have a cable subscription and watches all of their favourite content on Netflix. Worse still, a non-fan probably cut cable out ages ago. The latter two are bad outcomes for cable companies because all of that is churned revenue that they may never get back.

These losses in cable customers, tied with de-bundling of cable content puts Disney-owned ESPN and WB-owned TNT in precarious positions during these ongoing media rights negotiations. With Disney doubling down on Disney+, the idea of selling ESPN has been floated by none other than CEO Bob Iger. A combination of issues that puts the NBA’s dreams of a record media deal in jeopardy.

A Silver Lining

The NBA will be hoping that the streamers, notably Amazon Prime Video, Apple TV, Youtube TV and even Netflix toss their hats in the bidding war for basketball’s most lucrative league. The economics of the current media situation make it so that these cash-laden technology companies are uniquely positioned to potentially take the sport onto their sites to grow their recurring subscription revenues. Despite this, the streamers themselves have to establish whether such an expensive commitment will make economic sense for the future growth of their businesses. In 2021, Amazon paid the NFL $1 billion per year for 10 years for the right to air Thursday Night Football, and this year incorporated interactive ads that allowed customers to make Amazon purchases during the broadcast. This may indeed be the future of sports viewership.

However this pans out, it will be very interesting to observe who wins the right to air NBA basketball for the next decade. On the consumer side, questions arise on where you would rather watch your basketball, TNT or Youtube? Amazon or ESPN? Will the cable companies charge exorbitantly to make up for lost revenues? Will streaming sites fill your broadcast with ads? All these possibilities await, as fans of the sport watch on impatiently.